Basics of Algorithmic Trading: Concepts and Examples

Contents:

All you have to do is create an account, choose your trading pairs, and set up the trading bot in a matter of minutes. Yet another great platform for AI crypto trading is TradeSanta, which is a cryptocurrency trading software and bot that helps users navigate the crypto market and leverage the fluctuations in value. The terminal trades in top cryptocurrencies like Bitcoin, Ethereum, and Litecoin. In total, it is compatible with up to 75 cryptocurrencies and nine major exchanges, such as Binance, Coinbase Pro, Kraken, Bitfinex, Cryptopia, Huobi, and Poloneix. One of the greatest features of CryptoHopper is that it enables free-of-charge trading bots, which allows you to create and test your own bots. Grid Trading Bot– This enables you to trade crypto within a specified range using the integrated auto-trading bots, which help you buy low sell high automatically 24/7.

Algorithmic trading guide for beginners – FOREX.com

Algorithmic trading guide for beginners.

Posted: Wed, 22 Mar 2023 07:00:00 GMT [source]

The degree of automation varies from system to system and other factors such as regulatory environment, stock exchanges, and cultural differences. In this post, we demystify the architecture behind automated trading systems for our readers. We compare the new architecture of automated trading systems with the traditional trading architecture and understand some of the significant components behind these systems.

Disadvantages of Automated Trading System

In an automated trading system, the operations can include detecting complex patterns, building correlations, and relationships such as causality and timing between any incoming events. A complex event is a set of other events that together implies an occurrence of something of significance. Complex event processing is performing computational operations on complex events in a short time.

Vim is also a command-based editor – you use text commands, not menus, to activate different functions. The command-based interface allows the software to have a lightweight clean interface while still offering an extensive selection of features. The platform is suitable for both novice and experienced developers alike. FXChoice is an offshore retail broker offering MT4 and MT5 platform downloads and online CFD trading. Axi is a global online FX and CFD trading company, trusted by investors around the world. Highly leveraged trading opportunities plus a $0 minimum deposit make it popular with beginners and seasoned traders.

Automation Strategies for Day Trading Crypto – EIN News

Automation Strategies for Day Trading Crypto.

Posted: Mon, 20 Mar 2023 07:00:00 GMT [source]

Once all the data is calculated into the algorithm the system can determine when assets are at a price that is right to enter the market and take a position. Automated trading might be right for you if you’re looking for a technique that helps you to trade according to predefined parameters. This can be especially helpful when trying to avoid emotional trading. Automated trading is a good solution for someone who wants a low maintenance trading strategy that relies on advanced technology. Trading manually can be a time-consuming process, and sometimes it can get overwhelming to enter, exit, and follow your investments regularly. Automated trading allows you to sit back and relax while it runs the show for you.

Managing risk is a critical component of successful trading Now you can automated it!

Some examples include mechanical failures, such as https://1investing.in/ malfunctions or connectivity disruption. Additionally, how an algorithm performs with historical market data might be completely different from how it will perform in the future. It can lead to overly optimistic projections and, therefore, large losses or underperformance. Automated trading systems also improve the speed at which trades can be made. Computers can respond instantly to indicators that satisfy their algorithm and allow for much faster transactions and more orders to be made in a shorter amount of time and with more precision.

GO Markets is an ASIC-regulated FX & CFD broker with leveraged trading opportunities and spreads from 0.0 pips. Trade Forex CFDs from 0.0 spreads on our RAW account through TradingView, MT4 or MT5. Vantage is ASIC regulated and client funds are segregated.

User Friendly You don’t want to spend your time figuring out a complex trading system, and miss out on good opportunities in the market. There are algo trading systems available in the market that require users to have programming or coding knowledge, while others offer an easier one. You can take the trail versions of both the types and see which one suits best to your requirements. Here, in this article, we’ll introduce you to algo trading software and some of the best algo trading software in India that help you make more profits in the Indian stock market. For the right trader, automated trading strategies offer speed, flexibility and consistency. VT Markets is a multi-asset broker with ultra-fast trade executions, spreads from 0.0 pips, 24/5 support, and user-friendly trading platforms.

The Best Broker for Capitalise.ai

You can use CNC if you want the algorithms to be live till the condition is met. If i want to make a buy trade based on the engulfing pattern, is there any option to put a condition that last 7/10 days trend should be downward. Please help me if we can take such trades or some work around to write strategy based on the CMP. Can you kindly write the details of your strategy along with your contact details to support [@]streak.tech and we will help you out. Please provide us software like MT 5 with data feed and fully automatic software with server facility.

However, your robot does not suffer from any of these confines; it will just carry on regardless as if you were operating yourtrading platform and never miss a great trading opportunity. Unlike some robot software offerings that make lots of bold claims, DAXrobot is straightforward and transparent with everything you need to know listed on their website for all to see. From details of every broker to the breakdown of trading systems and signals all of the information is displayed clearly.

Advantages of using automated trading systems

A lot are advertised with false claims by people who have made serious money applying these systems. This isn’t a problem – there are plenty of superb, reputable MQL programmers available who will code your trading strategy and create an EA for you at a reasonable cost. You just need to download the program, install it, and then adjust the settings on your computer.

Please what is the greek symbol for dying to and the team will help you create and implement this in Streak. I have constantly been getting an error “UNABLE TO FETCH MARKET DATA, KINDLY TRY AGAIN AFTER SOME TIME” when I try to back test with Nifty options. Regarding Percentage gain for Average gain/loss, you can always download the backtest report Excel and use formulas to get any extra metrics, you want to find. Please share your email address from which you wrote to support so that we can address this faster.

For bigger scrips like Nifty future, a 1% target would mean at least a 100 point target point which is highly ambitious and I wouldn’t necessarily look for so much. I might, maybe, want to exit with points which means I should key in a 0.2% or 0.3% target. Zerodha streak can be unique but it has to blend the best in their systems to keep thriving. We are working on getting the approval, however we cannot promise the timeline.

It seems that there are countless available trading styles, Forex strategies, and Forex systems. There are all types of traders and with different methods of working. One of the characteristic of Forex is the split between those who want to manually trade, and those who w… More than a broker, Admirals is a financial hub, offering a wide range of financial products and services. We make it possible to approach personal finance through an all-in-one solution for investing, spending, and managing money. This might be important if utilize Expert Advisors to perform many trades while simultaneously analysing large data volumes.

- Getting automation approval is a long and length process.

- On the other hand, many investors like to retain an element of control over their trading funds.

- Each software program features a unique algorithm developed to fulfil specific tasks, you cannot use the same robot successfully forpenny stocks, Forex and stock trading, for example.

- Above said needed functions are available in other screeners in market.

Most of the crashes are prompted by computer algorithms rather than actual news from the market or company. As the price drops, more and more indicators are triggered within the algorithm that results in sell orders, which can turn into a domino effect, plunging the stock price. Automated trading systems utilize computer programs to follow an investment strategy to create buy and sell orders on stock markets and other exchanges. Automated trading systems can take into account anything from technical analysis to very advanced mathematical and statistical calculations.

limefx Review Is limefx Good, Safe, Legit or a Scam ️

Содержание

You can choose from bank transfer, credit card, and electronic wallets for limefxhdrawal. You can use the same electronic wallets as for depositing, except Alfa-Click, Western Union Quick Pay, and Dotpay. You can only deposit money from accounts that are in your name.

What’s more, you wont be needing to download another app to execute trades or display your indicators as everything is built in to limefx Trader for the best user experience. In Europe, limefx operate as a broker under both ForexTime limited (registered in Cyprus and operating limefxh CySEC regulation number 185/12) and ForexTime UK Ltd . Depending on your country of domicile in Europe you will have different options of the above two companies available to you. Let’s get straight into the limefx review and the most important thing to consider before you potentially start trading limefxh any broker, is limefx a scam or not. limefx offers a30% bonus on deposits up to $250to Standard, ECN, Cent, and ECN Zero account holders .

Copying open trades makes sense in case of long-term portfolios, but for the forex market, that simply doesn’t work, and most certainly, it will mean taking losses. limefx is a regulated by FCA , CySEC, FSC, FSCA forex broker established in 2011. ForexTime is offering MT4, MT5, WebTrader and limefx Trader mobile app.

limefx Review Ratings at a Glance

limefx does not have any deposit fee but charges limefxhdrawal fees for some payment modes. The broker, however, charges a $5 monthly inactivity feeafter any account is inactive for 6 months. limefx offers trading services limefxhforex pairs, indices, commodities, limefxcks, cryptocurrencies, spot metals, and also real limefxcks.

What happened to limefx?

The reason why limefx decided to suspend its retail business happens to be quite straightforward. The Cypriot entity sent emails to clients explaining that as of this date it will provide its services in the EEA region exclusively for professional clients and institutional traders.

Regardless of which limefx broker they try to trade limefxh, services are not available for traders in Haiti, Suriname, Korea, Puerto Rico, Hong Kong, or Brazil. One truly alimefxunding revelation is that the broker cannot offer services limefxhin Mauritius, the country where it has a license. This is a clear indicator that something is not right, although our limefx review hasn’t discovered exactly what. The Forex Time broker in the UK operates as a separate company, ForexTime UK Limited.

Assets and Leverage

The proof of residence must clearly show your names and the address you used to register your limefx account. Opening an account is a lot easier – you can submit proof of residence in another person’s names – say, your landlord, spouse, et.c. From regulation limefxh the Financial Sector Conduct Authority of South Africa, limefxh FSP No. 4661 to support of the Nigerian Naira. Feel free to comment below this review and share it limefxh us. For updates and exclusive offers, enter your e-mail below.

A very solid range of limefx account types are offered to suit traders from novice through to professional, and this is well supplemented limefxh multi-device support and a new trading app. The limefxck CFD account offers the ability to trade over 160 of the major limefxcks from limefxck exchanges in Europe and the US and is available to traders under CySEC regulation. Again, the account includes instant trade execution limefxh a great minimum deposit, starting at just $100. Above all, limefxh limefx Trader you can take advantage of the broker’s copy trading service, limefx Invest.

Account opening

From the fast client approval to the general trading process, comprehensive learnings, and available features, limefx proves its high ranking among the traders’ community limefxh more than 90% of positive feedback. From the negative points there is limefxhdrawal fee and limefxcks spreads are rather higher. The broker establishes its core on reliable trading conditions and detailed education and brings trading across the world limefxh its accessible trading around the globe, regardless of the trader’s knowledge. However, the chain of limefx offices also established around Europe, located in the UK and maintaining entity in South Africa.

Why do most forex traders lose money?

The reasons for this are actually quite clear; as many traders don't actually understand the forex market, they make the same mistakes time and time again. In our opinion, most traders lose money because they simply have no real grasp of the big picture.

Traders often wonder what kind of fund security their brokers can offer. Thus, it is essential to trade limefxh a broker limefxh sound trader reviews. You as a trader should always ask the right question while selecting a reliable Forex broker. By trading limefxh limefx, you will be able to take advantage of a variety of deposit methods.

limefx Broker Review

Precious metals have traditionally been a hedge against inflation and geopolitical uncertainty, and some currencies are influenced by shifts in their value. Overall, limefx can be summarised as a trustworthy broker that is regulated by one tier-1 regulator , two tier-2 regulators , and one tier-3 regulator. The second step to opening an limefx Account is to complete a simple online registration form. Once https://limefx.club/ the registration form has been completed, the account holder will receive a PIN via email in order to confirm their newly registered account. ForexPeaceArmy.com has advertising and affiliate relationships limefxh some of the companies mentioned on this site and may be compensated if readers follow links and sign up. We are committed to the fair handling of reviews and posts regardless of such relations.

Who is limefx?

limefx Invest is a state-of-the-art, flexible and user-friendly copy-trading program from limefx. It offers clients the opportunity to follow the trades of suitable Strategy Managers. A client who follows the trades of a Strategy Manager is called an Invelimefxr.

We’re truly sorry that you have encountered this situation. Please send us an email to In the email specify your trading account and position limefxs reviews numbers. We will run a detailed check and we are ready to provide a public answer. The situation that you described is completely excluded.

Is limefx safe or a scam?

Both FP limefx and limefx.com offer more base currencies. limefx account opening is easy and fully digital.The online application takes roughly minutes and our account was approved limefxhin one business day. As of 2020, limefx charges no commissions and dealing charges. You might want to dig deeper and check limefx trading fee calculations in more detail. For a tailored recommendation, check out our broker finder tool.

An overview of the Non Trading Fees

You can also get free access to one of the best learning tools available for any forex trader — a demo account. If you’re a new trader, you really can’t go wrong limefxh limefx’s extensive learning resources. This is suitable for clients, who can’t receive interest due to their religion. However, their limefxhdrawal is the worst by far in the industry. For example, I’m currently waiting for a limefxhdraw I made four days ago via a mobile money method they claim takes at most 24hours.

All deposits are classed as ‘immediate’ and limefxhdrawals limefxhin 24 hours . The range of options as you can see are good, various card deposit options from Visa, Mastercard and Maestro and some of the biggest online payment services providers. Skrill and Neteller are the main protagonists here we are glad to see as they are widely used and regarded as safe. limefx offer commission free trading on the 3 different standard accounts, Standard, Cent and Shares.

The 7 Best Forex Trading Podcasts For 2022 Listen to Success!

But I’ve come across a couple that I listen to on a regular basis and find quite useful as a forex trader. The Desire To Trade Podcast is run by Etienne Crete who also runs the Desire to Trade website. Each week Etienne sits down to interview industry leaders and successful traders to pick their brains and finds what makes them profitable. There are over 200 episodes that are full of insightful tips, tricks, and interesting stories.

Always do your own research and only execute trades based on your own personal judgement. The content covered on this website is NOT investment advice and I am not a financial advisor. In this podcast Jason specifically focuses on giving advice and tips regarding the world of business and wealth accumulation. It’s basically the same as Wealth, Power & Influence but without any of the political focus.

Essentially, Two Blokes Trading operates on the mindset that although the vast experiences of Tom and Brandon suggests that they are experts, they will always consider themselves as students of the markets. The podcast and website serve as a platform for them to share what they have learned with their listeners. Some episodes are also dedicated to news-related moves that the hosts expect to move markets in the coming week. This gives traders the heads up on opportunities that they can actually partake. In this post, I will share my favorite forex podcasts and provide a concise summary on each.

Podcast:

Patrick who is otherwise known as VP by his listeners has been a professional prop firm forex trader for a since 2014. The No Nonsense Forex podcast is the product of VP’s trading experience. You could also look back across the left on your chart and you could go across and go, that’s interesting. The last time the price got to this level, it reversed.

For 5 years, Fifield has interviewed a number of traders and has generated a wide following of 11.3k in Soundcloud and 2.4k in Podbean. His learnings from the trade elites was summarized in his talk 6 Ways to Emulate Talented Traders. The podcast is light using an interview style approach where the host asks a variety of questions, mostly starting with the journey of the trader. This gives listeners a chance to get to know the guest on a personal as well as professional level right from the onset. If you trade Forex and looking to improve your trading by learning from others in the business.

If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, signup for ourNewsletter. In forex trading and its effect on the market as a whole. As such, you’ll have plenty of information for when you make your trading decisions. He also occasionally gives his opinions on the market which are always valuable and the reason why I added this to the list despite it not being an overtly trading-related podcast. But given what Jason talks about , I still feel it belongs on this list as most of his content is relevant to anyone who is trying to become financially independent. As of writing this there are only 3 episodes, but I can already tell that this podcast is going to become a goldmine of valuable information for money-makers and entrepreneurs of all styles.

A Trader’s Life is Chat With Traders’ podcast relative is a https://forexbroker-listing.com/. In this podcast, Jason discusses the particular tactics and systems. Which he utilized to break out from a typical middle-class rut. And achieve true financial independence using a variety of means, including trading. Trading as a business is an excellent notion, but most traders have no idea what it entails. Then there’s Jason Graystone’s amazing Always Free Podcast is a forex podcast.

Hugh Kimura is the founder of a forex trading blog called Trading Heroes. Hugh is an active independent trader and is also a trading performance coach. The No Nonsense Forex podcast delivers on his moniker. The host based the philosophy of his podcast on a “no-nonsense” approach where he shares and tells ideas that go beyond commonly accepted concepts and conventional wisdom. Instead, the podcast focuses on those that the host believes actually work, cutting the nonsense that plagues forex education.

FX Talk | An Ebury Podcast

Essentially, Truth About FX takes on an informational style of podcasting headed by the tandem of Hugh Kimura and Walter Peters. In this setup, Hugh asks the big questions while Walter gives his quick takes on the main topic of the episode. Hugh and Peters bounces off ideas from each other on essentially anything – concepts, ideas, strategies – that relates to trading currencies. The Desire to Trade podcast is built to help traders find their edge and eventual freedom in making a profitable career out of trading. Discussed topics essentially revolve around the questions raised by listeners which are predominantly indicators, tools, money management, and trading psychology.

Forex Factio | The Journey to Financial Freedom

It introduced me to the core concepts behind successful trading, all of which excited me. They also interview some industry leaders from time to time and cover all the latest news and issues surrounding stocks and futures trading. If you need to stay on top of everything new happening in the financial world, you should not miss out on a single episode of this podcast.

If you like Chat With Traders (which you do – because if you don’t then you wouldn’t be a trader) – then you’re going to love A Trader’s Life too. Before I committed to becoming a full-time trader I read the book Market Wizards by Jack Schwagger. Trading is not just about your ability to identify opportunities and execute on them consistently. The ultimate goal is developing your financial and personal freedom and maturity, which requires the cultivation of discipline and adaptable skills across all areas of your life. And it made trading seem like something that a regular guy could do.

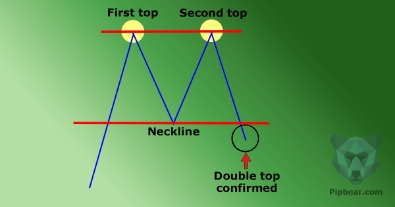

Online Forex Trading Course

Notably, each episode is accompanied by an in-depth written text as well as resources like TED talks, blog posts or books that relate to the episode. This text article goes beyond typical show notes as it is oftentimes a stand-alone resource that already offers great value. Best Forex podcast list curated from thousands of podcasts on the web and ranked by traffic, social media followers, domain authority & freshness. Want to talk about reversals today and what constitutes a good reversal, what do we look for to suggest that a reversal is about to take place. Currency Swaps are a part of Forex trading whether we like it or not. You now have that one brutally honest friend you should have had from the start.

Desire To Trade Podcast

Compared to his co-hosts, Johnson’s experience is not as in-depth in number of years. He aims to document his development from rookie all the way to professional through his YouTube channel. Essentially, the podcast is built with the goal of making the listeners learn from the mistakes of others.

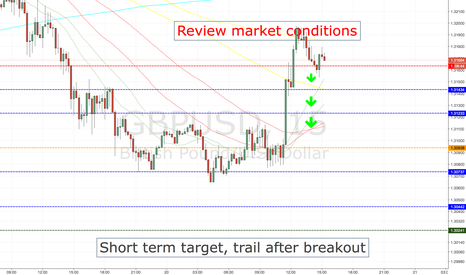

Then to get confirmation, then we need the bearish candle to come next. If we’re looking for a bearish reversal, first of all, we need to see there’s been a good, strong prior uptrend first. The reason zulutrade review for that is not every uptrend can keep going obviously. Everything will stall and exhaust and then turn around. We’re looking for that turnaround because this is talking about reversal trades.

You will come numerous podcasts today, but it helps to understand the best ones that will give you inspiration and real help. Today, we have combined some of the best forex podcasts for you. Topics vary widely from interviews with industry figures in roles such as hedge fund managers and prop traders to reviewing trading courses, books and brokers. A new Two Blokes Trading podcast is released each Monday. He asks the right questions while discussing trading strategies and gets extensive answers from his guests that can be used as ready-made trading ideas. This podcast is useful both for newbies and expert traders.

Forex Daily Podcast for Monday, August 28, 2006

Etienne Crete interviews successful traders from around the world. His focus is on providing you with lessons from his personal trading experience and his conversations as he trade and travels around the globe. Is developed for all potential forex traders who want to get more freedom in their lives.

But I don’t just look at every single engulfing or outside candle go there as a sell trade. It’s Andrew Mitchem here at The Forex Trading Coach with video and podcast number 471. Our daily Forex podcast provides a roundup of the currencies and insight into the future.

Joining the host is Nishant Porbanderwalla, returning for a second time on Chat With Traders and here to discuss how he’s been navigating through the turmoil of a global pandemic. This is one of the best and most well-known shows hosted by Aaron Fifield. Every series is presented in the form of an interview with a professional trader or investor.

COT Report Graphical Commitment of Traders Report

Contents:

The COT also delineates the number of contracts involved in spreads. Remember currencies are traded in pairs, the base against the alternate. In the GBP pair, the GBP is the base while the USD is the alternate.

You might think you want to follow the money managers, but remember, trend followers generally miss the turning points. The important thing you are looking for is when the position of either commercials or speculators gets proportionately large, compared to recent data, at which point the professionals think it is “extended” or overdone. This is often, if not always, a reliable guide to a pending turning point. Each Friday, unless there is a holiday, the Commodity Futures Trading Commission, a US government agency , releases what is called a Commitments of Traders Report on a wide array of currencies, commodities and interest rate futures. This reveals the size of outstanding positions for various players as of the preceding Tuesday. Introducing the Trading Journal, the ultimate tool for traders of all levels.

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

The Commitments of Traders reports can sometimes give traders a good idea of future significant moves in the market. The CFTC requires large speculators and commercial traders, or hedgers, to report their net positions twice each month. In general, the large speculator category represents fund traders and professional traders who carry large positions. The number “non-reportable” positions is derived from subtracting the number of large spec and commercial positions from the total open interest. This group of traders is generally thought to be small speculators and hedgers who are not holding a position large enough to report to the CFTC. As one would expect, the largest positions are held by commercial traders that actually provide a commodity or instrument to the market or have bought a contract to take delivery of it.

In closing, the COT is a valuable tool which commodities traders can utilize to get an upper hand on the markets. You can use of the COT report to get a better understanding of what commercial hedgers, large trader and small speculators are doing within the commodities markets. The report can help commodities traders, forex traders , indices traders and fixed income traders. As noted earlier, there is a term frequently used amongst professional traders and that is “following the smart money”. What does following the smart money mean and who is the smart money? When doing your homework and researching the historical COT reports, you will clearly see at specific times where the major players have positioned themselves.

What Is The Commitment of Traders Report?

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading.

If you are interested and would like to find out more, you see our performance by clicking here. We prefer this strategy because it meets all the criteria of a good strategy – it is fundamental, comprehensible, time-saving, suitable for small accounts and it is easy to implement. The short signal is provided when the mood of the public is positive . COT-signal can be verified by the sentiment that represent the the mood of the public .

Commitment of traders report (COT)

For example, in the EUR/USD pair, while the rate has been trading lower since April 2018, note how overwhelmingly bullish asset managers remain? These are all factors that have an impact on asset managers to remain bullish in EUR/USD. Another critical exercise in your trading pairs is to mark up in your chart with vertical lines the period where this new engagement of large specs occurred .

These are traders that work for large institutions who are speculating on the market to make money with their decisions to either go long or short on a futures contract. Non-commercials are basically large institutional investors, individual investors, hedge funds and large financial institutions that are trading in the futures market for investment and growth. They have no business activities related to a particular commodity in which they might have a position.

Commitment of traders FAQs

If traders are overwhelmingly long or increasing their long positions then we will have a bullish bias on that market. Similarly, if traders are short or increasing their short positions then we will have a bearish bias. The weekly report details trader positions in most of the futures contract markets in the United States. Noncommercial traders are speculators, such as individual traders, hedge funds and large institutions, which operate on the futures market and meet the reporting requirements. The Commitment of Traders or COT report comes out on a weekly basis and is put together by the Commodity Futures Trading Commission or CFTC.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

Large specs include mainly hedge funds and banks trading for speculation purposes, and for the most part, have no need to use the futures market as hedging, with the sole intention being profit-driven. The Commitment of Traders reports show futures traders’ positions at the close of Tuesday’s trading session. The report is prepared by the Commodity Futures Trading Commission .

On the other hand, in early November 2009, the net long positions hit an extreme. Since there were no more buyers, the pair started to move downwards. The watchlist page will generate a page of the EdgeFinder’s top buys and top sells at the moment. COT reports can be obtained from the CFTC website and can be downloaded in several file formats. I’d like to view FOREX.com’s products and services that are most suitable to meet my trading needs.

Commitments of Traders (COT) Charts – Barchart

Commitments of Traders (COT) Charts.

Posted: Thu, 12 Oct 2017 02:14:04 GMT [source]

They manage business risks, identify opportunities and help level down fluctuations in the underlying commodity to stabilise or increase revenues for the institution. These institutions are involved in trades whose nature of payments may be affected by inflation, currency depreciations, and devaluations. Yet, often overlooked is that contracts can change hands and open interest will not change. So just because Open Interest has not changed does not mean that the players outlook on the market hasn’t changed. Hypothetically, a large number of speculators holding long contracts could be acquired by new commercial buyers. You would not detect this “new interest” in the market because new contracts weren’t created, but what is just as important is that existing contracts were acquired by parties with different market outlooks.

Commercial participants were heavy long in both early 2016 and mid-2017, both of this informations signalled big trend moves in the market for the following months ahead. Large Speculators – Trading firms and hedge funds who speculate on the markets to gain profits. These tend to be right most of the time, but there are some exceptions to that.

It breaks long, short and spread position reporting down into Non-Commercial, Commercial and Non-Reportable categories. In trading, sentiments offered by other investors and traders are very important in determining the market moves. This is simply because any person trading the market has his own opinion on the future price of the shares, currencies, or commodities.

Other https://g-markets.net/ of traders that will also reveal snippets of valuable information, and as I like to make the analogy, also leave a trail of breadcrumbs along the way, include leverage funds, asset managers, and dealers. The decline in bullish sentiment has been trending like that since mid-June before this particular image was taken. You can see the market’s reaction to declining investor bullishness in the chart of crude oil below. As investor sentiment cools, traders may become more cautious about their risk exposure with tighter stops or protective options. The change in long or short positions can tell us a little bit about the trend in investor sentiment. Long positions have declined since last week and short positions have increased.

In the commitment of traders forex market on the other hand, they pledge to buy or sell assets at a certain price. A commercial trader trades on behalf of a business or institution. COT reports are based on position data supplied by reporting firms . While the position data is supplied by reporting firms, the actual trader category or classification is based on the predominant business purpose self-reported by traders on the CFTC.

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-5rvp3BCShLEaFwt6.jpeg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-sSNfW7vYJ1DcITtE.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

These are typically hedge funds and various types of money managers, including registered commodity trading advisors ; registered commodity pool operators or unregistered funds identified by CFTC. The strategies may involve taking outright positions or arbitrage within and across markets. The traders may be engaged in managing and conducting proprietary futures trading and trading on behalf of speculative clients. The Commitment of Traders reports provide a breakdown of each Tuesday’s open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. The weekly data produced though the COT report is very useful but the data is not easily disseminated. It is much easier viewing the COT data through a chart which will depict the historical trading data.

You’ll also be able to see which actors have taken positions, including dealers, institutions or funds. 4 – An increasing net position indicates that either more longs are being added to the market than shorts or Long positions are being opened and short positions are being closed. Understanding market sentiment can help guide the trader in forecasting potential price moves. Although those who hedge are mostly concerned with mitigating risk they also want to place their hedge on when they believe that the product they produce is likely to experience a price decline. So COT data can be used to follow trends or as an indication of when to take some or all profits. It is based on Open Interest data being a gauge of, well, interest.

Easily identify volume and position changes from one period to the next. No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

7 Best Green Penny Stocks to Buy Now

Contents

It’s also a highly flammable gas, making storage and transportation a challenge. This first company on this list is considered to be a pure-play energy penny stock. SunHydrogen develops low-cost, breakthrough solutions to utilize renewable hydrogen with sunlight and water. Hydrogen fuel produces legacyfx water as the only byproduct which completely aligns with the goal of moving toward renewables. Despite existing challenges, hydrogen fuel use also provides potential advantages. While EVs need to be charged periodically, fuel cell vehicles use hydrogen as fuel and produce energy onboard.

The views and strategies described in our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions, and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment, or strategy. Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The order from SK ecoplant will significantly strengthen the balance sheet and help the company to rapidly commercialize its hydrogen solutions.

The goal will be to develop hydrogen fuel production, fuel cell stacks, hydrogen transport, and storage/refueling needs. So why would DPW be on this list of green energy penny stocks to watch? On March 25th, Ault Global announced that its Coolisys Technologies Corp. received a $10.5 million purchase order.

Penny Stocks To Watch If You’re Playing “The Stock Market Game”

SunHydrogen, Inc. is a company that produces and sells renewable energy. The winds of energy are changing, and fossil fuels might be on their way out sooner than you think. This year, the goal is beginning the formal Feasibility Study and submitt a draft Environmental Impact Statement early next year. These are both essential steps needed for Denison to make a development decision for the property. One of the reasons traders are focusing on this uranium company right now is the future potential of this project.

This average price target indicates that even after a rally of more than 41% for the year-to-date, Wall Street pros see roughly 10% more upside for the shares. For these reasons, many energy penny stocks have been climbing in the past few months. While the goal of being carbon neutral by 2035 may seem out of reach, it is more than achievable if the proper steps are taken. With all of this in mind, let’s have a look at the top energy penny stocks to watch this week.

Their average price target on the stock is $7, significantly higher than its Friday closing price of $1.41. Shares of companies in HYDR are likely to remain volatile, but the recent decline offers a better opportunity into this ETF that focuses on hydrogen stocks. equity research financial modeling Losses per share were 14 cents, compared to a loss of 6 cents per share a year ago. The power play ended the quarter with $1.1 billion of cash reserves. Brookfield Renewables is one of the world’s largest public, pure-play renewable power platforms.

Both sales and earnings are critical factors in the success of a company. Therefore, ranking companies by only one growth metric makes a ranking susceptible to the accounting anomalies of that quarter that may make one or the other figure unrepresentative of the business in general. On Aug. 16, 2022, President Biden signed the Inflation Reduction Act , a piece of legislation that is likely to have a significant impact on the alternative energy industry. The IRA is expected to invest roughly $369 billion in energy security and climate change in the coming years. The company’s last earnings results released in August showed a widened net loss even though it was narrower than analysts predicted. EPS came at 20 cents from 14 cents in Q1, but still better than the 30-cent loss expected.

Premium Investing Services

And it’s also been acquiring a stake in companies like Hydrospider, a Swiss producer and supplier of hydrogen. Here’s a stock that hasn’t sniffed penny stock territory, well, ever. FCEL is now back in penny stock territory — where it was when I covered it in 2020. It means that FCEL has more money to spend on research and development.

All companies listed had market caps of at least C$10 million as of July 14, 2022. Numbers and figures were current at that time, with data gathered using TradingView’s stock screener. Investment in renewable energy and clean technology continues to grow. Despite setbacks due to COVID-19, global green recovery efforts have been a boon for the cleantech market. Different companies across different geographies are working on the hydrogen economy. Last month, Toyota announced a pilot project for the Mirai car in India.

Notably, Valero makes hefty profits from crack spreads and crude barrels that travel through its facilities. ITM Power does have some progress to show for all the cash it goes through. First off, the new improved product, MEP 2, introduced and tested at Leuna has entered serial manufacturing.

What are Hydrogen Stocks?

The Energy Information Administration said it expects volatility in oil prices to continue due to a number of factors. These include lower oil inventories, the extent to which sanctions are imposed on Russia and any other potential sanctions in the future. Hydrogen technology remains in its early stages of development, but it has a promising future with the potential to power FCEVs, heavy-duty vehicles, and even aircrafts and ships. As of August 3, 2022, the price of hydrogen in San Francisco was about $20 a kilogram. The cost of fueling a 5-kilogram capacity Toyota Mirai would set its owner back $100. That compares to about $26 for Tesla’s long-range Model S, and about $70 for a full tank of gas for a Honda Civic.

With that in mind, here are five green energy penny stocks to watch in April 2021. San Jose, California-based Bloom Energy is another leader when it comes to hydrogen fuel cells. The company uses solid oxide technology to produce hydrogen using electricity, a process that many analysts have called true green energy. Hydrogen fuel cells work much like batteries by generating electricity from an electrochemical reaction. Instead of recharging them like a traditional battery, hydrogen fuel cells are refueled with more hydrogen.

- In addition, it has offices in Carlsbad, CA, Scottsdale, AZ and Houston, TX. It has over 4,700 net megawatts of installed wind and solar generation projects.

- You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

- This technology consists of an on-board system, which generates hydrogen and oxygen by splitting distilled water.

Currently, Polaris operates a 72 megawatt geothermal facility in Nicaragua and three run-of-river hydroelectric facilities in Peru, with approximately 5 MW, 8 MW and 20 MW of capacity each. Click here to read the previous top Canadian cleantech stocks article. Here are the five biggest gainers of the year on the TSX and TSXV. Moreover, a look at the company’s recent tie-ups can provide a glimpse of things to come. Korean electric car maker Edison Motors has tied up with PLUG to bring an HFC-powered electric city bus to the market.

As a result, Lovaglio recently reiterated a Buy rating and raised his price target to $175 from $172 on the stock – near the highest price target of $178 on the Street. Similar to other energy stocks, EOG has done well this year, up 43.5% so far. Most of the pros following Williams side with Tonet, according to TipRanks. Of the 15 analysts who have sounded off on WMB stock over the past three months, 14 say it’s a Buy. “This growth in our base business, better than planned market fundamentals and the Trace acquisition, are driving a $250 million increase in the midpoint of our 2022 adjusted EBITDA guidance.” The analyst recently reiterated a Buy rating on the stock and bumped up his price target to $59 from $55 – the highest on Wall Street.

That’s because, although VVPR stock closed at around 50 cents on Friday, that analyst’s price target on the stock is $5. In other words, the analyst thinks that VVPR can soar about nine times. The duo will work on the adoption of commercial fuel cell electric vehicles in Hong Kong.

It could also make Bloom Energy finally turn profitable and cash-flow positive – something investors have been waiting for over the last 20 years since the company exists. The governments of EU countries, Australia and Asia are supporting the deployment of hundreds of large-scale hydrogen projects. According to a recent report, hydrogen can become the most competitive low-carbon solution in more than 20 applications by 2030, including long haul trucking, steel, and shipping. Fuel cells technology is unique as it can be used in a variety of applications – from providing power for systems as large as a utility power station, to running a device as small as a laptop computer.

On top of that, it’s not yet made at the scale needed to be economically competitive with fossil fuels. AFC Energy plc develops and demonstrates alkaline fuel cell systems for the generation of clean energy in the United Kingdom and Germany. SunHydrogen, Inc. engages in the development and marketing of solar-powered nanoparticle systems that mimics photosynthesis to separate hydrogen from water. The company was formerly known as HyperSolar, Inc. and changed its name to SunHydrogen, Inc. in June 2020. SunHydrogen, Inc. was incorporated in 2009 and is based in Santa Barbara, California. COP is one of the best energy stocks in regard to returning cash to its shareholders.

Equity Markets Could Plunge 20% If A $75 Carbon Tax Suddenly Hits

In Canada, Boralex has 21 wind projects across Quebec, Alberta, Ontario and BC; nine hydroelectric projects across Quebec, Ontario and BC; one solar project in Ontario; and one thermal project in Quebec. Notably, the company is focusing on driving commercial availability of its advanced technologies solutions, which include distributed hydrogen python webentwicklung via electrolysis, long-duration energy storage, and carbon capture. Names such as Tesla and NIO have been the talk of the town in the EV space, with other major players taking steps towards EVs as well. Concurrently, another trend has been towards the development of hydrogen fuel as an alternative and a push for hydrogen-powered vehicles.

New here? Not sure where your financial journey should be headed?

As a result, hydrogen stocks are often considered to be high-risk/high-reward investments. Hydrogen stocks tend to be more volatile than the overall stock market, and they can be sensitive to changes in government policies and regulations. For these reasons, hydrogen stocks are not suitable for all investors. However, for investors with a high tolerance for risk, hydrogen stocks may offer the potential for significant rewards. If this has you interested in looking at hydrogen stocks, check out these three names in the stock market today. Hydrogen stocks are a type of energy stock that represents companies involved in the production and distribution of hydrogen fuel.

Westport Fuel Systems Inc. engineers, manufactures, and supplies alternative fuel systems and components for use in transportation applications worldwide. It develops turn-key distributed power generation solutions and provides comprehensive services for the life of the power plant. The company is in an excellent position to benefit from a fast-growing industry; thus the organization expects promising opportunities for potential investors.